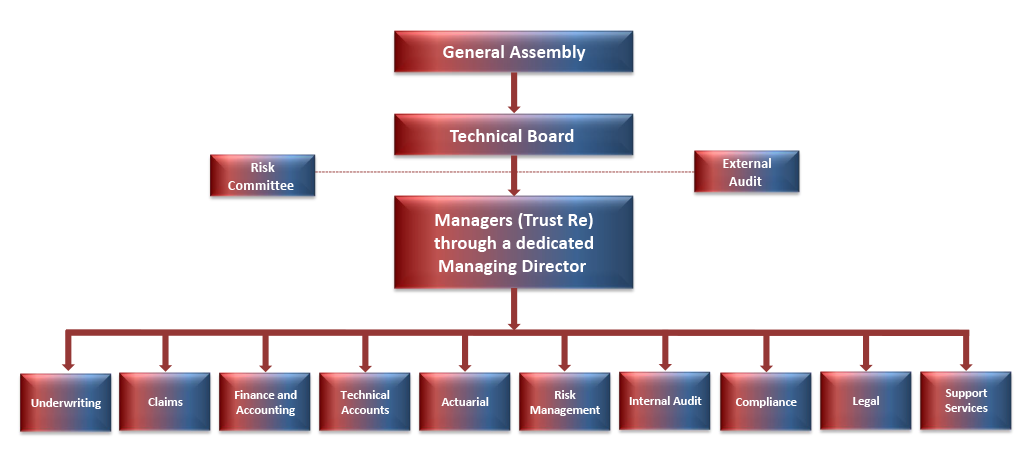

RISK COMMITTEE

|

Omar Gouda

Chief Executive Officer |

Chairman |  |

|

Ahmad Noor Azhari Abdul Manaf (Arie)

President & Chief Executive Officer |

Member |  |

|

Romel Tabaja

Chief Executive Officer |

Member |  |

|

Sundaresan Sridharan

Group Head Tech. & R/I |

Member |  |

|

Nabil Hajjar

Managing Director of the Syndicate |

Secretary |  |

The Risk Committee, whose members are elected from amongst the Technical Board Members but with a different Chairman, assists the Board in fulfilling its oversight responsibilities for the identification, analysis, assessment, embedding and management of all the risks which the Syndicate faces, both operational and technical, and which may have a financial impact on operations.

The Committee meets at least twice a year and preforms its duties in accordance with a pre-approved “Risk Management Policy”

ENTERPRISE RISK MANAGEMENT (ERM)

The Syndicate aims to ensure an appropriate risk-reward balance in all its activities, within an Enterprise Risk Management (ERM) framework and risk control cycle applied to the operation to encourage informed decision-making and strategic analysis while meeting the requirements of effective corporate governance and protecting the interests of the Syndicate’s Members. We therefore base our risk management on the following guiding principles:

CONTROLLED RISK-TAKING

We implement a clearly defined risk control framework, which includes adherence to our Risk Appetite, and all underwriting and procedural guidelines contained in the constantly updated Master Operation Handbook (MOH).

EFFECTIVE STRATEGIC RISK MANAGEMENT

The risk-rewards analysis forms a major part of our decision-making process, it is implemented to ensure effective integration of Risk Models into the Syndicate operation and optimize the decision making process.

CLEAR ACCOUNTABILITY AND RESPONSIBILITY

The Syndicate operates on delegated and clearly defined authority levels. All staff are accountable for the risks they identify and/or assume. These are aligned with the overall objectives and are embedded in the risk management process.

PROTECTION OF BALANCE SHEET FROM SHOCK EVENTS

The Risk management function monitors the Syndicate’s risk-taking activities. Our risks evaluation process includes the analysis and understanding of the financial impact and business implications from the potential occurrence of infrequent large events.

INTERNAL AND EXTERNAL INDEPENDENT AUDIT

Internal and external independent audit is performed for operations of the Syndicate. This covers all risks and internal controls identified in the risk register to ensure adequacy of internal controls and adherence to the policies, procedures and guidelines set in the Master Operation Handbook (MOH)